Steel Producers Take Different Paths to Reach ESG Goals

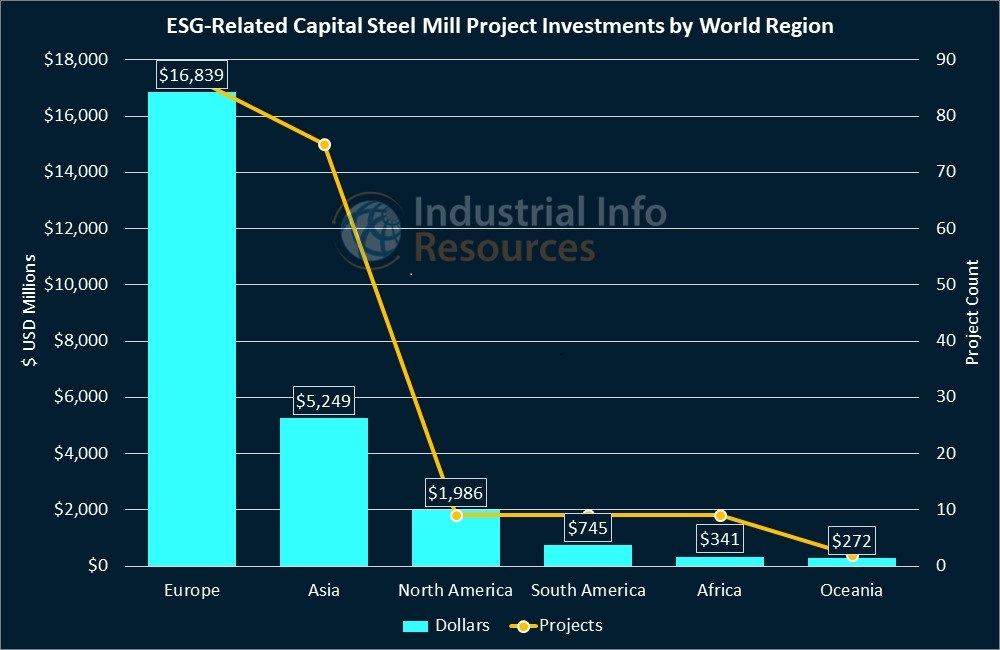

When some people think of a steel mill, they may envision a facility that belches out smoke and CO2, thus contributing to global warming. Truth be told, there are a lot of those still out there in the world. In the U.S., however, the big U.S. steelmakers have pledged to achieve net-zero carbon emissions by 2050, and at least one of them says it is working to reach that goal much earlier. Industrial Info is tracking nine environmental, social and governance (ESG)-related steel mill capital projects in the U.S. and Canada, worth nearly $2 billion. Subscribers to Industrial Info's Global Market Intelligence (GMI) Metals & Minerals Project Database can click here for a detailed list of project reports. On a global basis, the European steel industry dwarfs all others when it comes to ESG activity (see chart below). More governments in Europe have implemented carbon-reduction mandates for their steel producers, while any ESG-related endeavors by steelmakers in the U.S. are done on a voluntary basis, often at the urgings of their stockholders.

Cleveland-Cliffs Incorporated (NYSE:CLF) (Cleveland, Ohio) is one of the U.S. steelmakers that has pledged to achieve net zero status by 2050. Chief Executive Officer Lourenco Goncalves has hinted his company may reach net zero emissions ahead of that deadline.

Estimates vary greatly regarding the amount of greenhouse gases produced by the steel industry. According to a 2020 report by McKinsey & Company, every ton of steel produced in 2018 emitted on average 1.85 tons of carbon dioxide (CO2), equating to about 8% of global CO2 emissions.

Goncalves maintains Cleveland-Cliffs' operations already emit less CO2 on average than the industry as a whole as a result of its direct reduced iron (DRI) method of steelmaking; at the company's most recent quarterly earnings conference call, he spoke about the future use of hydrogen in the company's steel mills as a means to further reduce carbon emissions. He spoke of the future use of hydrogen to replace coke in the production of steel at the company's Indiana Harbor complex blast furnace 20 miles northeast of Chicago. The hydrogen serves as a reductant and source of heat in the steelmaking process, releasing steam, whereas using coke releases CO2. Subscribers to Industrial Info's Global Market Intelligence Metals & Minerals Plant Database can click here to learn more about the Indiana operations.

Cleveland-Cliffs would pipe in the hydrogen from the proposed Midwest Hydrogen Hub, which was recently awarded a federal grant of as much as $1 billion to proceed with development. For related information on the hydrogen hubs, see October 19, 2023, article - Seven Hydrogen Hubs Selected to Receive $7 Billion in DOE Funding.

"Cliff's commitment to buy a large portion of the output from the Midwest Hub helped get this location selected by the Department of Energy," Goncalves said during the conference call. "Our decision to use hydrogen as our decarbonization path set us apart from the crowd, and that will be accomplished in a much more cost-effective and quality-driven manner."

Other steelmakers are pursuing different paths to achieve their ESG goals. Thinking outside the box, Nucor Corporation (NYSE:NUE) (Charlotte, North Carolina) and Helion Energy Incorporated (Everett, Washington) are studying sites to build a 500-megawatt (MW) fusion power plant to provide electricity to a Nucor steel facility. The project would prevent the release of 500,000 metric tons of CO2 annually. Construction of the fusion reactor would begin in 2029, with completion in late 2030. Subscribers to Industrial Info's GMI Project Database can click here for the project report.

In Canada, ArcelorMittal (NYSE:MT) (Luxemburg) plans to kick off construction in 2024 on a 2.5 million-metric-ton-per-year DRI plant at its Hamilton Steel Works in Ontario. The project, planned for completion in late 2026, is part of the company's transition of the site to DRI-electric arc furnace steelmaking, "which carries a considerably lower carbon footprint and removes coal from the ironmaking process," the company said in a 2022 press release. The DRI furnace initially will run on natural gas but will be constructed "hydrogen ready" so it can be transitioned to use green hydrogen "when a sufficient, cost-effective supply of green hydrogen becomes available," the company said. Green hydrogen is produced without fossil fuels. Click here for more information.

Subscribers to Industrial Info's GMI Database can click here for all project reports mentioned in this article and click here for the related plant profiles.