IIR Project Spending Index Slides into Negative Territory After Nearly Three Years of Growth

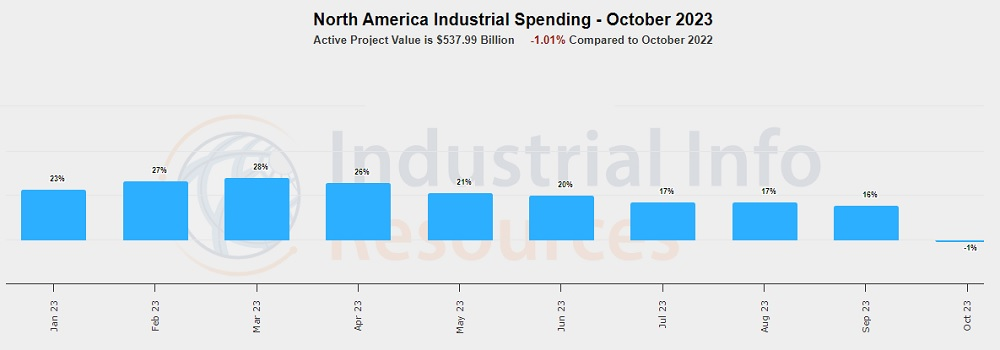

For the first time since December 2020, Industrial Info's latest North American Industrial Project Spending Index recorded a drop in year-over-year project spending.

The active project value for October was $537.99 billion, down 1.01% from the same month in 2022. The Project Spending Index is a monthly indicator that compares active spending rates with the same month in the previous year to get a measure of growth or contraction in the industrial market. The index provides spending details by industry and market region.

For October, five of the 12 industries followed by Industrial Info registered spending drops from the same month in 2022. For 2023, spending has trended down since March.

One of the largest drops was felt by the Industrial Manufacturing Industry, which fell $64.46 billion, or 30.54%, on a year-over-year basis. In September, an outlook survey by the National Association of Manufacturers (NAM) indicated that U.S. manufacturers continued to report a downtrend in expected capital expenditures. For more information, see September 18, 2023 article - U.S. Manufacturers' Capital-Spending Expectations Continue Downtrend, Despite Project Activity.

According to the U.S. Federal Reserve System's November Beige Book on current economic conditions, economic activity slowed since the previous report, with four U.S. Federal Reserve districts reporting modest growth, two indicating conditions were flat to slightly down, and six noting slight declines in activity. Retail sales, including autos, remained mixed, while sales of discretionary items and durable goods, like furniture and appliances, declined on average, "as consumers showed more price sensitivity."

Manufacturing activity was mixed, and manufacturers' outlooks weakened, according to the Beige Book, while the economic outlook for the next six to 12 months diminished over the reporting period.

In the Eleventh District, which includes Texas and parts of New Mexico and Louisiana, outlooks "worsened, and uncertainty remained elevated with numerous contacts citing geopolitical instability and high interest rates as headwinds." However, Texas manufacturing activity "expanded modestly" in October, as production increases were led by fabricated metals and machinery manufacturing. In the energy arena, "Oilfield activity was flat to up over the past six weeks. The recent spate of mergers and acquisitions continued to put slight downward pressure on activity levels."

Getting back to Industrial Info's Project Spending Index, onshore oil and gas production showed a $26.42 billion increase in October, up 47.63% from the same month in 2022. The U.S. Energy Information Administration (EIA) recently reported that it expects North American exports of liquefied natural gas (LNG) to more than double from the current 11.4 billion cubic feet per day (Bcf/d) to 24.3 Bcf/d by the end of 2027. For more information, see November 14, 2023, article - EIA: North American LNG Exports to Double Through 2027.