U.S. Solar Readies for $30 Billion in Second-Quarter Kickoffs

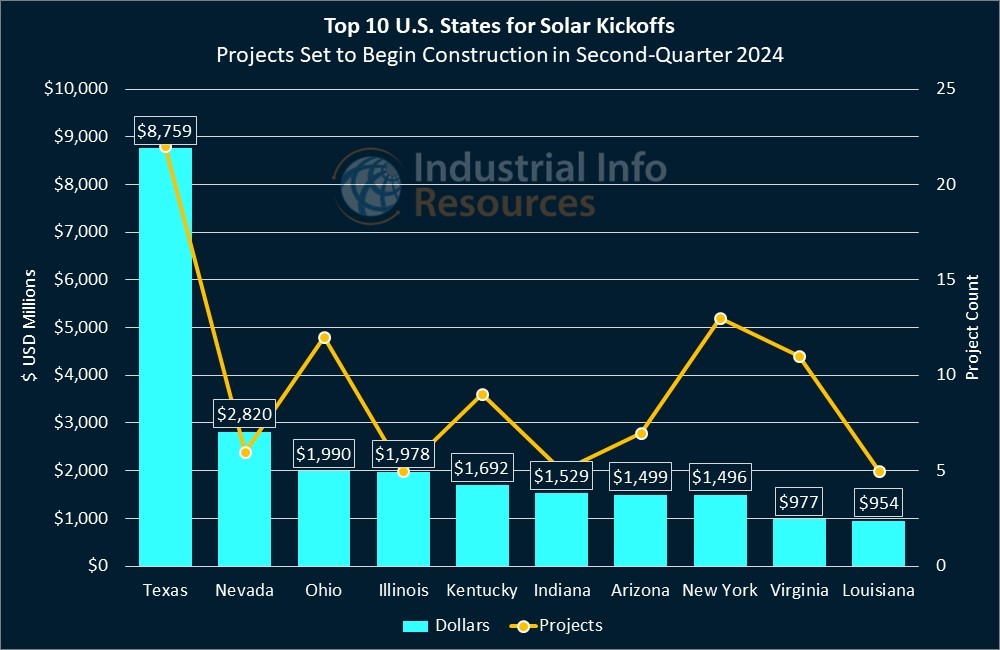

With the U.S. expected to see up to 36.4 gigawatts (GW) of utility-scale solar generation added to its power grid in 2024, fueled partly by improving supply chains and easing trade restrictions, some of the top states for the energy resource are preparing to notch up major project kickoffs. Industrial Info is tracking more than $30 billion worth of active and planned solar-generation projects across the U.S. that are set to begin construction in the second quarter, about half of which is attributed to projects with a medium-to-high (70% or more) probability of kicking off as scheduled.

Everything is bigger in Texas, including the outlook for solar generation. The Lone Star State alone accounts for nearly 30% of the investment in projects slated to kick off in the second quarter, including Enbridge Incorporated's (NYSE:ENB) (Calgary, Alberta) $1.38 billion Cadillac Solar Project in Putnam, which is set to generate 956 megawatts (MW) across two phases. The $771.4 million Phase I and the $612 million Phase II both will use photovoltaic (PV) panels developed by Renogy (Ontario, California).

Enbridge picked up the Cadillac projects when it acquired Tri Global Energy, then one of the leading renewable-energy developers in Texas, in 2022. "The more renewables investment aligns well with our corporate strategy and supports our energy transition and growth expectations," said Greg Ebel, the chief executive officer of Enbridge in a quarterly earnings-related conference call, later adding: "We've structured our renewable business very differently from some of the folks that you see out there, i.e. long-term power purchase or contracts for projects, even before they're built or immediately upon construction."

Subscribers to Industrial Info's Global Market Intelligence (GMI) Power Project and Plant databases can read detailed project reports on Cadillac Phase I and Phase II, and read a detailed plant profile.

NextEra Energy Incorporated (NYSE:NEE) (Juno Beach, Florida) is another major solar developer with project kickoffs planned across multiple states in the second quarter. The company is preparing for a $530 million expansion of its Dunns Bridge Solar Plant in Tefft, Indiana, which will add 435 MW to the existing 265-MW facility, which was completed in August 2023. It also aims to develop a 70-MW solar plant in Circleville, Ohio; the projects are slated to use panels developed by Canadian Solar Incorporated (NASDAQ:CSIQ) (Guelph, Ontario) and JinkoSolar (NYSE:JKS) (Shanghai, China) respectively.

In a recent earnings-related conference call, John Ketchum, the chief executive officer of NextEra, was upbeat about the U.S. market outlook for solar in 2024: "Solar panel and battery prices have already declined by roughly 25% from their peak over the last 24 months, heading into 2024. We have proactively procured critical electrical equipment to complete our renewable projects, securing enough transformers and breakers to cover our expected build through 2027. And due to our scale and construction partnerships, we have not experienced any labor shortages impacting project timelines." Subscribers can read detailed reports on the Dunns Bridge and Circleville projects.

Ohio trails only Texas and Nevada in its total investment in second-quarter solar kickoffs, with the latter state home to ibV Energy Partners LLC's (Miami, Florida) $250 million Boulder Flats project in Boulder City, about 20 miles southeast of Las Vegas. The project, which is set to wrap up toward the end of 2025, includes a 113-MW solar farm and a 60-MW, lithium-based battery energy-storage system (BESS) unit. The company says it has signed power-purchase agreements with Southern Nevada Water Agency, the state's water agency, and a private off-taker. Subscribers can learn more from a detailed project report.

Illinois, another top state in second-quarter kickoffs, is home to a smaller solar-BESS project: Vistra Energy Corporation's (NYSE:VST) (Irving, Texas) proposed addition to the power station in Hennepin, a defunct coal-fired plant that closed its doors in 2019. The project would comprise a 24-MW solar plant and a 6-MW BESS unit. Subscribers can learn more from a detailed project report.

Subscribers to Industrial Info's GMI Project and Plant databases can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for active and planned solar-generation projects across the U.S. that are set to begin construction in the second quarter.