U.S. Renewable Jet Fuel Primed for Major Growth This Year

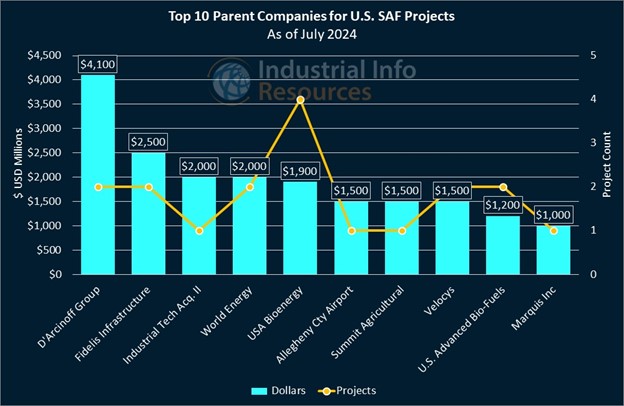

The U.S. market for sustainable aviation fuel (SAF) production is on the cusp of dramatic growth, according to the U.S. Energy Information Administration. Two big-ticket projects could boost overall annual production from roughly 2,000 barrels per day (BBL/d) to as much as 27,000 BBL/d before the end of 2024, and they could double the number of plants in the U.S. that could produce SAF. An alternative to conventional jet fuel, SAF is produced from agricultural and waste feedstocks and is consumed in blends with petroleum jet fuel. Industrial Info is tracking more than $24 billion worth of projects related to the development of SAF across the U.S., most of which are in their early planning stages.

One of the two big-ticket projects began production earlier this summer: Phillips 66’s (NYSE:PSX) (Houston, Texas) $600 million Rodeo Renewed project in Rodeo, California, which converted the 120,000-BBL/d Rodeo Refinery complex into a 50,000-BBL/d renewable fuels plant that produces renewable jet fuel, a key component of SAF, as well as renewable diesel and renewable gasoline, from used cooking oil, fats, greases and soybean oils. Subscribers to Industrial Info's Global Market Intelligence (GMI) Alternative Fuels Project and Plant databases can learn more from a detailed project report and plant profile.

“People want to lower the carbon intensity of their fuels and to maintain their quality of life,” said Jolie Rhinehart, the vice president of the newly renamed Rodeo Renewable Energy Complex, in a press release. “The result is that demand for renewable energy will continue to rise.”

The other major SAF project that could begin production (although not likely reach full completion) before the end of the year is from Diamond Green Diesel LLC (DGD), a joint venture between Valero Energy Corporation (NYSE:VLO) (San Antonio, Texas) and Darling Ingredients Incorporated (Irving, Texas): the $315 million addition of an SAF unit at its renewable diesel complex in Port Arthur, Texas. Valero says upon full completion, expected in 2025, the complex will be able to upgrade "approximately 50% of its current 470 million-gallon annual production capacity to SAF." Subscribers can learn more from a detailed project report.

Two U.S.-based facilities already produce a combined 2,000 BBL/d of SAF: World Energy LLC's (Boston, Massachusetts) biofuels plant in Paramount, California, and Calumet Specialty Products Partners LP's (NASDAQ:CLMT) (Indianapolis, Indiana) refinery in Great Falls, Montana. Subscribers can read detailed profiles of the Paramount and Great Falls plants.

The Paramount facility began work in early 2023 on a $1.5 billion SAF expansion, which is expected to increase its production from 42 million to 340 million gallons per year. The expansion is expected to wrap up in early 2026. It will be supported by a $1 billion modernization of the complex to process only renewable feedstocks, which is expected to wrap up in early 2025. The Paramount facility also is part of California's Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES), a state initiative to accelerate renewable hydrogen projects and related infrastructure.

Subscribers can read detailed project reports on the SAF expansion and overall modernization at World Energy's Paramount facility.

World Energy also is considering a proposed SAF plant in Galena Park, Texas, on the eastern side of Houston, that would involve revamping and converting a decommissioned biodiesel plant to process animal fats and cooking oil into 250 million gallons per year of SAF. If constructed, the project would bring World Energy closer to its goal to produce 1 billion gallons per year of SAF by 2030. Subscribers can learn more from a detailed project report.

President Joe Biden has set a goal of eliminating all fossil fuels from the aviation sector by 2050. The Build Back Better Act, passed in 2021, committed $1 billion to biofuels research and infrastructure, which helped to incentivize SAF efforts.

But not everyone in the industry is enthusiastic. Brian Moran, the chief sustainability officer at embattled airplane manufacturer The Boeing Company (NYSE:BA) (Arlington, Virginia), said in April it's "highly unlikely" that SAF will reach cost parity with conventional jet fuel. For more information, see April 26, 2024, article - Boeing Wary of Cost Future for SAF.

Subscribers to Industrial Info's GMI Project and Plant databases can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for projects related to the development of SAF across the U.S.