U.S. Nears Historic Buildout of Natural Gas-Fired Generation

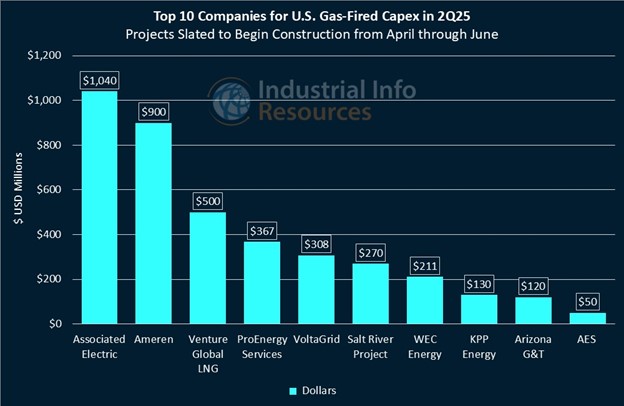

The U.S. natural gas-fired power-generation business is on the cusp of a prolonged expansionary period, with the encouragement of a fossil fuel-friendly president and seemingly endless demand from newly emerging data centers. Most utilities have kept gas-fired generation in their integrated resource plans, and many are rushing to expand capacity. Industrial Info is tracking more than $4 billion worth of gas-fired generation projects that are set to kick off in the second quarter, nearly half of which is attributed to grassroot projects.

SRP's is the second of two phases, each of which involves adding six of General Electric's (NYSE:GE) (Boston) LM6000 PC SPRINT combustion turbines. The first phase kicked off in mid-2024 and is expected to wrap up in the summer of 2026; the second phase will begin this summer and take at least two years. Each turbine has a 50-megawatt (MW) output; with the current capacity at 726 MW, the Coolidge plant's output will exceed 1 gigawatt (GW) following completion. Subscribers to Industrial Info's Global Market Intelligence (GMI) Power Plant and Project databases can learn more from a detailed plant profile and reports on Phase I and Phase II.

"The [Coolidge expansion project] is critical to our published goal of achieving 65% carbon intensity reduction by 2035 and 90% by 2050, because it will enable the addition of more renewable resources while maintaining the reliability of SRP's power system," the SRP said on its website.

AEPCO, which provides power for nearly all of Arizona's rural power co-ops, is adding a pair of GE's LM6000 models to its simple-cycle facility, to boost its output from 607 to 689 MW. It is part of a broader effort by AEPCO to eliminate coal as an energy source at its power plants by 2028; the fossil fuel accounted for about 90% of the utility's overall power production as recently as 2014. Subscribers can learn more from a detailed plant profile and project report.

Other expansions set to kick off in the second quarter include NorthWestern Energy Group Incorporated's (NASDAQ:NWE) (Sioux Falls, South Dakota) $32 million addition of two units at its power station in Yankton, South Dakota, which will increase capacity from 13.4 to 19.8 MW. The G20CM34 internal combustion units from Caterpillar Incorporated (NYSE:CAT) (Deerfield, Illinois) will replace two existing, outdated units. Subscribers can learn more from a detailed plant profile and project report.

Among the grassroot power-generation projects most likely to begin construction as planned in the second quarter is ProEnergy Services' (Houston, Texas) $367.2 million Elmax Peaking Power Station in Huffman, Texas, which is designed to start up quickly and provide up to 306 MW of energy when urgently needed. It comprises six GE's LM6000PC simple-cycle turbines. Subscribers can learn more from a detailed plant profile and project report.

These second-quarter capacity additions likely will coincide with a jump in natural gas prices, which analysts foresee amid rising demand from U.S. liquefied natural gas (LNG) export facilities and data centers. The U.S. Energy Information Administration (EIA) expects the Henry Hub natural gas price will increase in 2025 and 2026, which will accompany reductions in natural gas in storage. In its January Short-Term Energy Outlook (STEO), the EIA forecasts the U.S. benchmark Henry Hub natural gas spot price will increase in 2025 to average $3.10 per million British thermal units (MMBtu) and in 2026 to average $4.00/MMBtu, following a record low in 2024.

Subscribers to Industrial Info's GMI Project and Plant databases can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for gas-fired generation projects that are set to kick off in the second quarter.